My-Financial Plan

2016 INVESTMENT NEWS LETTER

|

The Lawrence Investment Group

21 January 2016 This is an Awful Month to be in the Market --- A Worse Month to Get Out

The current downturn is largely the result of rapidly falling oil prices and the market and economic turmoil in China. The volatility is aggravated greatly by machine and algorithmatic trading with virtually no human intervention. The good news is the same trading methods should accelerate the return to the upside when the price of oil finally stabilizes. We do not want to miss out on that.

My advice on what to do in this currently very volatile market is to stay the course as Vanguard Group founder Jack Bogle said Wednesday. “Investors thinking of selling amid the current market turmoil should resist the urge and just stay the course. Don't do something, just stand there. This is speculation that we're seeing out there, and you can't respond to it."

:

S&P 500 Average Decline Magnitudes, Durations and Recovers

Average Declines Recoveries

Type (% Decline) Count %Chg. #Mos. # Mos.

Pullbacks (55-10%) 59 (7) 1 2

Corrections (10%-20%) 19 (14) 5 4

All Bears (20%+) 12 (28) 14 25

>”Garden Variety” (20%-40%) 9 (26) 11 14

<”Mega- Meltdown”(40%+) 3 (51) 23 58

It is worth pointing out that this data is over a period of 70 years and heavily weighted to years before the advent of computer trading. Even with that, the average recovery time from a correction has been four months. More recent downturns and recoveries have been faster than these averages and I anticipate the recovery from this “correction” will be very fast.

If you are investing regularly into a well-diversified retirement program, do not stop when the market goes down. Of course, this market looks like a lemon today; but, do what we all know is best: make lemonade. The investments you are making today are buying equities at a 10% discount compared to late last year. To stop investing now is a failure to take advantage of these sale prices and you will pay for it in the long run. Think of it like buying a new car. If you have your eye on a $50k automobile and suddenly it goes on sale for $45k, would you buy it now, or because its value is reduced 10%, would you wait for the price to go back up?

Are we near the bottom? I cannot answer that. However, I know if you sell out now there is a greater than 90% probability that you will miss out on a major portion of the upturn. Remember, if you bought a $10 stock and it drops to $5, you have lost 50%. But, how much do you need to gain to get back even? It is not the obvious 50% answer. To get back to $10 on a stock that is currently $5, you need a 100% gain. You cannot afford to lose a portion of that because you are on the sidelines looking for a good opportunity to jump in.

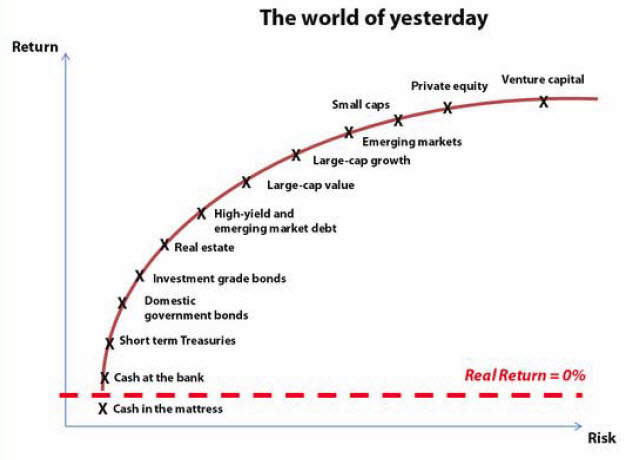

I have received numerous requests lately to provide a few thoughts on how to invest your IRA funds. To do that, I will again talk about purchasing power erosion and the risk-return curve. In general, it is important to be invested in something that provides a return at least as high as the inflation rate just to stay afloat. You can, of course, put your money under your mattress or invest in CDs or savings accounts at less than 0.25% but the result is a loss in purchasing power, purchasing power erosion. The current rate of inflation is approximately 2% and any investment that yields less than that is providing a negative real return.

To understand what that means, assume that a loaf of bread costs $2 today and that you are 50 years old with a plan to retire at age 65. At today’s inflation rate of 2%, that same loaf of bread will cost you $2.70 at age 65 or 35% more than today. That means for the same amount of cash as you put under your pillow today, in 15 years you can only buy $2.00/$2.70 or 74% of what it buys today. Your purchasing power has eroded to 74% of age 50 levels. The current inflation rate of 2% is historically low. If you use the historical rate of 4%, that same loaf of bread would cost you $3.60 at age 65, 80% more than today. Your purchasing power has eroded to 55% of age 50 levels. If the money you have saved at near zero interest rate was planned to provide you $50,000 a year in retirement, you will be disappointed to find that it has only $28,000 of purchasing power.

This example serves to illustrate that your retirement savings must be invested to grow at a minimum rate equal to the rate of inflation. Of course, our goal is always to grow our savings at a rate higher than inflation and thus enjoy the fruits of increased purchasing power in retirement. As an aside, when planning for retirement income, you must remember that your IRA savings will be taxed as ordinary income at your marginal tax rate upon withdrawal. Therefore, if in the above example you planned to have your savings provide you $50,000 per year of income; be sure to remember this is $50,000 per year before taxes.

Now, to answer the question of how to invest you retirement IRAs. It should be obvious that you must invest in something that provides a return equal to or greater than the rate of inflation with a level of risk with which you are comfortable. That is where the risk-return curve comes into play,

|

|||||||||

As you can see, the investments that provide the highest return also incur the highest risk. In retirement planning, the goal must be to avoid purchasing power erosion while managing the amount of risk we are willing to take while preserving capital.

This graph, The World of Yesterday, assumes that any return above zero is good and would lead you to believe that low return investments like money in the bank or short term treasuries are good vehicles for retirement saving. The problem, however, is the other topic I discussed which is purchasing power erosion. To address that very real issue, we must use a different risk-return curve which is The World of Today.

|

|||||||||

If we look at the risk-return curve today, it is obvious that the majority of fixed income investments will provide a negative return when accounting for the purchasing power erosion that occurs when investment yield is less than inflation. Consider a 2 year treasury bond yielding 0.25% as an example. With inflation running at around 1.7%, (The Real Return = 0% red line) anyone buying such an instrument is locking in a -1.5% real capital loss for the next two years. In short, in today’s world, it is almost impossible to gather any kind of real returns on fixed income instruments without either taking significant duration risk and/or quality risk, i.e.: moving up to the right of the curve.

So, just what is the answer? What is an investor to do to achieve real capital return with a suitable amount of risk in a retirement account? In my mind, that is Exchange Traded Funds or mutual funds. I always prefer mutual funds as the fund manager is able to adjust investments, within limits, based on market conditions. If you just want to keep up with the S&P 500 rate of return, then the VOO ETF, Vanguard 500 ETF, is a fine way to go. Warren Buffet is on record as stating that most investors would do just fine to have all of their investment in this ETF.

My problem with that is the lack of diversification that I believe is essential to consistently beat the inflation rate and the S&P 500 index. S&P index is largely based on large cap stocks. However, I also want exposure to small cap stocks, foreign stocks, blended funds (bonds & stocks) and real estate trusts as a minimum. That includes five of the first six points on the graph that are above the 0% yield line. Yes, I am moving up in return as well as up in risk. But, by being diversified, my risk is spread along the curve. To determine my level of diversification, I use the Morning Star Mutual Fund Matrix and have enclosed a link to a good tutorial of how it works.

http://www.investopedia.com/articles/basics/06/stylebox.asp

You could put everything in the VOO to get started or get more sophisticated by equally distributing assets across the matrix. Remember, it is important to get started and get out from under the mattress. At today’s prices, you can invest any amount in most funds for less than $10. If a week or a month from now you want to change your investment allocation, it is very inexpensive to do so. Many folks get analysis paralysis in trying to get the perfect investment and end up doing nothing for months or longer. The result is a stash of cash not working for you and deteriorating in its purchasing power.

In my next letter, I will talk about the risk-reward tradeoffs of individual stocks vs Mutual Funds and ETFs. For those of you looking for stocks in your wealth building accounts, I only have a couple of recommendations today:

DIS: Disney remains a great stock with the twin franchises of Frozen and Star Wars. It has been dragged down (too far in my opinion) by the threat of loss of sales of ESPN as subscribers abandon full bundling from service providers. I expect ESPN revenue to decrease; but, I believe that has been accounted for and DIS is very oversold.

V: Visa is a transaction processing play, not a bank, and as such continues to thrive as long as consumers are spending.

XOM: I know Exxon seems like a strange call. But, look at it as a “Growth Bond” that is paying 4% interest while it is waiting for the market to settle and drive Exxon to renewed growth. It takes courage.

I invite you to join me in building and preserving financial wealth to compliment “true” wealth: faith, family and friends.

Larry Hollatz, RFC®

3 March 2016 The Downturn May Be Over – Focus On Style

Is the market on the path to a real recovery or is this just another head fake? None of us really know the answer. I have reiterated to many that I cannot call the bottom but focus on the long term. In a private communication to several of you, I suggested that we were at the bottom of this downturn on 9 Feb. Looking at the charts since then, I was apparently two days early as the Diamond Bottom occurred on 11 Feb. Again, none of us knows if this is real or if there are more downturns ahead.

I believe the market will slog forward, albeit not at a torrid pace, for several reasons. First and foremost, the FED cannot raise rates. Oh, sure, they can talk about raising rates but are unable to do so. With the rest of the world, and especially Europe, maintaining rates lower than ours, the FED is trapped. Also Ms. Yellon is very concerned about the real unemployment rate, the U6, which is still at 10%. The government loves to site the improvement in the U3 rate which is down to about 4% but excludes the long term unemployed and under employed. She never mentions the U6 directly but always mentions her concern with the long term unemployed, the under employed population as well as the record low participation rate. If you apply those concerns to the U3 rate, you then have the U6 rate and that is her concern; the true unemployment rate.

Second, the decreasing productivity continues to be a drain on profits. Today’s report shows a productivity decrease of 2.2% for January. It is one thing to hire more people and thus reduce unemployment, but it is quite another to grow your business, and the economy, when productivity decreases. With a 2% productivity decrease, if a company with 100 employees hires two more, they get no more work done and no more product built than they did before. That means they have increased their costs by two employees and have nothing to show for it except increased costs and decreased profits. It will be hard to grow the market with a decreasing productivity head wind hitting corporate profits. The last time we had increasing productivity was 2014 and what a year that was.

And finally, the market has been over sold during the current downturn. Much of the current recovery is driven by the belief that oil prices are near the bottom; and, the rest of the economy is in better shape than the market indicates. There is a lot of uncertainty and volatility; but, I expect a general melt up of the market.

Because it is so difficult to predict the market, for years I have been advocating that investors take a long term view of the market, especially for our retirement investments. We must develop a well-diversified portfolio of mutual funds and/or ETFs for our retirement plan. I am always asked about stocks and bonds in those portfolios. Here are a few thoughts on them.

Bonds: Conventional wisdom is that we should have about 20% of our retirement portfolio in bonds and increase that allocation as we get closer to retirement. The problem with conventional wisdom is that we are not in conventional times. The return on two year and ten year treasuries is so low that they do not keep up with inflation. It is of no value to have a long term retirement program that has returns that are less than inflation. That is a formula for a very disappointing retirement.

But, what about the risk of equities vs the security of bonds? Here is a chart to illustrate.

EQUITY VS BOND RETURN

$1000 INVESTMENT RETURN DOWNTURN AT YR 5 TOTAL VALUE YR 10

Bond 1.5% none $1161

Mutual Fund 10% none $2593

Mutual Fund 10% 30% $1616

Mutual Fund 10% 50% $1297

Assume you start your retirement account with $1000 and hold it in a portfolio of mutual funds that provide a return of 10% over 10 years. (An historically reasonable number). At the end of 10 years, that investment would have a value of $2593. If you invested that same $1000 in U.S. treasuries for ten years at 1.5% interest (a reasonable blend of 2 year and 10 year interest rates) you would have a value of $1161 and, because of inflation, would have less purchasing power than when you started.

But, what about the risk of equities vs the security of bonds? In the equity mutual fund scenario, assume that your investment of $1000 has a 50% loss after five years. If you hold your reduced position, after the 10 year period your investment will have a value of $1297 or almost twice the gain of the bond investment. Recall from the last letter, there have only been three downturns of 40% or more in the last 70 years. I did the same exercise with a loss of 30% (that has happened 9 times in the past 70 years) rather than 50% after the fifth year and the result was a portfolio value of $1816 at the end of the 10 year period. That is 5 times the return of the secure bond fund.

Of course, we need to be smart in how we manage all of this. If the 50% loss occurred in the tenth year, there would be no time for recovery. Therefore, we must become more conservative as we actually approach the time of our retirement.

Stocks: The other question I am often asked is why I recommend funds rather than individual stocks in retirement funds. The answer is all about risk. Recall the risk/reward curves from my January letter. Individual stocks can and do often provide a greater return than a mutual fund; but, they can also have a much greater loss. The vast majority of retirement investors have very little financial knowledge and do not take much time to manage their investments. Therefore, 80% of 401k retirement portfolios are on Auto-Pilot. That works for mutual funds but not for individual stocks. Let’s look at the risk.

The lowest risk in U.S. equities is an index fund of the S&P 500 index. In fact, just last year, Warren Buffet suggested that just such an index fund was the best possible retirement investment for the vast majority of 401ks. Of course the index is comprised of stocks of the 500 largest companies in the country. There is a pyramid of risk in this index as follows:

S&P 500 RISK

LOWEST

HIGHEST

The bottom is comprised of the 500 individual stocks each with its own inherent risk. Above that are 67 industry groups. For example, if you like gold mining in this market, you can do the research and invest in an individual company with its own very high inherent risk and watch it daily. A less risky investment would be a fund or ETF in the Mining-Gold Industry Group which is made up of 30 mining companies. Now, if one of those companies fails, you incur a significantly lower risk of loss than if you owned that specific company.

Above the Industry Group level of the pyramid are ten sectors. The gold mining industry group is in the Basic Materials Sector. You could reduce your risk significantly more if you invested in a materials sector fund or ETF. The S&P 500 index funds which I have discussed are at the peak of the pyramid. As you move up the pyramid from individual stocks, to industry groups, sectors and the index ETF, your opportunity for gain is certainly reduced but your risk of significant loss is reduced even more.

I want to emphasize that I am not against holding stocks in any portfolio that you actively manage. That means you look at the holdings at least weekly and keep track of what your stocks are doing. Because the risk of holding an individual stock is 80 times the risk of holding the sector, which is still more risk than holding the index, I am adamantly against holding individual stocks in any portfolio that you run on Auto-Pilot. And since 80% of 401ks are run on Auto-Pilot, I generally discourage the use of stocks in retirement funds. If you need more negative encouragement, look up the history of Enron and Lucent, both of which I have owned.

Mutual Funds vs ETFs: The final question I get on this topic is why I recommend Mutual Funds or ETFs. If you have begun to digest all of the complexity of indexes, sectors, industry groups and individual stocks, I think you will understand why I want good managers to manage these investments for you. There are many ways to hire an investment manager but, by far, the most cost effective way to get the best manager is to buy a Mutual Fund. Remember that in a fund, the manager makes the investments and the changes that he/she thinks will best meet the goals of the particular fund. ETFs are cheaper specifically because they are not actively managed. An ETF exactly mirrors the holdings of a specific area (index, sector, industry group, etc.) and is run by a computer algorithm with no management interaction. That means when you select an ETF, the management responsibility defaults to you. You need to understand the make-up of the ETF, the market in which it trades, and the trading techniques employed. Again, if you have a retirement fund, or any portfolio that you want to run on Auto-Pilot, I would not suggest a portfolio of ETFs.

To achieve the investment goals I strive for, I want to be the manager of managers. I want to determine in what areas I want to invest to have the best diversified portfolio I can create to meet my goals and then hire the best manager I can find for each investment. Those managers are the Mutual Fund managers of the seven to ten funds I use to make up the portfolio I own or manage. I use seven to ten rather than just one because each of these fund managers is an expert in his particular area. For example, for Large Cap Growth, I chose the Fidelity Contra Fund -FCNTX- which has been managed by William Danoff since 1990; I could not hire a better manager. For my Moderate Allocation Blended Investment, I chose the T. Rowe Price Capital Appreciation Fund –PRWCX- managed by David Giroux since 2006, another excellent manager.

In this manager of managers approach, I gain the wisdom of the very best financial managers in the world at a very low cost and deploy them across diversified portfolios. I use mostly Fidelity Investment, T. Rowe Price, and Vanguard Funds. The only ETF I use is the Vanguard S&P 500 Index –VOO- because Warren Buffet told me to. The result beat the S&P 500 for each of the past five years.

Although my focus for retirement investments remains on mutual funds and ETFs, I continue to hold and recommend stocks for your wealth investing portfolios. The difference, of course, is that you must actively manage those accounts; you cannot put them on Auto-Pilot as so many retirement investors do. In my last letter, I recommended three stocks; V, XOM, DIS and my all-time stealth favorite, AAPL. I would like to comment on all of them with performance based on growth plus dividends paid from 21 Jan. through 1 March.

V: Total gain of 4.75% with strong outlook for continued growth. Over the next several years, both MasterCard and Visa should gain substantial processed-transactions market share versus local European networks given two key market changes:

First, effective June 9, the next tranche of European payments regulation creates an even playing field for Visa (ticker: V) and MasterCard ( MA ) to take share of domestic processed transactions from the local European networks. Second, Visa and MasterCard have a clear competitive advantage in tokenizing mobile payment transactions, a capability that even the largest local European networks do not yet have. This gives Visa and MasterCard a distinct competitive advantage once tokenized services such as Apple Pay are launched and gain adoption throughout Europe. Visa expects to complete the acquisition of Visa Europe in third-quarter/fiscal 2016, making Europe a critical earnings driver over time. Continue to hold and acquire V.

XOM: Total gain of 11.7% as the price of oil has stopped its free-fall and seems to have stabilized. XOM announced today that its dividend will not only be preserved but will be increased this year. As many other energy companies experience distress as their cost of servicing debt with reduced revenue will force them to divest assets, XOM is in a good position to acquire some of those assets at distressed prices. Continue to hold XOM for its 4% dividend and acquire on pull backs.

DIS: Total gain of 3.9% with big Star Wars hit and park attendance off the charts. Walt Disney recently announced that it will adopt seasonal pricing for 1-day tickets to help spread out visitation. Each month will be divided into value, regular and peak days and tickets will be priced higher during peak days. The company is looking at ways to manage visitation as it works to open several new attractions (or “experiences”, as it terms them) in its parks during 2016, including a Frozen inspired musical experience, Soarin’ Around The World, as well as the new Star Wars experience. As per our estimates, Park and Resorts is the most important division for Disney, accounting for more than 30% of its valuation. In Q1 FY2016, Disney’s revenues from Parks and Resorts witnessed a 9% increase compared to the same period in the previous year. During the holiday season of 2015, the company had to shut its gates when the park reached maximum capacity, turning down visitors. As the U.S. economy improves and low gasoline prices lead to higher disposable income, higher traffic in Disney’s U.S. parks and resorts is likely in 2016. Accumulate below $100.

AAPL: Apple had a total return of 5.5% over this period; and, although I did not list it in the last letter, long time readers know my opinion on this stock. I believe it is poised for a 20% plus gain in 2016, with an increase in dividend payout to be announced in April. Just today, analyst Kulbinder Garcha of Credit Suisse states Apple shares could rise by almost 40% this year. Revenue growth will be driven by the launch of a low end, iPhone 6se (??) in March and the iPhone 7 in Sept. Growth will also be impacted by the introduction of new iPad models and the upgrade of their MacBook pc line. Apple Pay was just introduced in China and should also contribute in a small way to growth. Accumulate below $100 and hold above.

I invite you to join me in building and preserving financial wealth to compliment “true” wealth: faith, family and friends.

Larry Hollatz, RFC®